|

|

|

|

|

|

Welcome to the Australian Ford Forums forum. You are currently viewing our boards as a guest which gives you limited access to view most discussions and inserts advertising. By joining our free community you will have access to post topics, communicate privately with other members, respond to polls, upload content and access many other special features without post based advertising banners. Registration is simple and absolutely free so please, join our community today! If you have any problems with the registration process or your account login, please contact us. Please Note: All new registrations go through a manual approval queue to keep spammers out. This is checked twice each day so there will be a delay before your registration is activated. |

|

|||||||

| The Bar For non Automotive Related Chat |

|

|

|

Thread Tools | Display Modes |

|

|

|

|

#1 | ||

|

FF.Com.Au Hardcore

Join Date: Jul 2009

Location: melbourne

Posts: 4,669

|

Why do people think we are seeing such high prices for houses particularly in Melb/Syd and other capital cities? Interest rates being low by our standards is one major factor.

Texas is actually doing well economically atm yet its median house price is quite low. https://www.zillow.com/ca/home-values/ California on the other hand has always had the highest prices in the US https://www.zillow.com/ca/home-values/ Here is an article on California housing that I believe is a great explanation for what we are seeing in Australia atm. http://www.lao.ca.gov/reports/2015/f...sing-costs.pdf Thought it may be a good discussion thread considering the impacts if it were to burst and the Feds seem to be making noises about addressing the issue in the next budget. |

||

|

|

|

| This user likes this post: |

|

|

#2 | ||

|

FF.Com.Au Hardcore

Join Date: Jul 2009

Location: melbourne

Posts: 4,669

|

Anyone selling up to take advantage of the market or are people still happy to try get in or invest in a second property.

|

||

|

|

|

|

|

#3 | ||

|

Regular Member

Join Date: Dec 2022

Posts: 53

|

|

||

|

|

|

|

|

#4 | |||

|

FF.Com.Au Hardcore

Join Date: Jul 2005

Location: Melbourne

Posts: 6,931

|

Sounds like the folks who aren't very good at making forecasts, aren't very good at interpreting data either.

That or they were just batting for the blue team. That or they were just batting for the blue team. https://www.abc.net.au/news/2023-02-...tion/102020610 Quote:

__________________

~~~~~~~~~~~~~~ Rides (past and present) Current: 2004 Ford Falcon 5.4L 3v Barra 220, Manual Past: Mitsubishi Sigma (m), Toyota Seca (m), Toyota Seca SX (m), Toyota Vienta V6 (m), Toyota Soarer 4L v8 (a), BA XR8 ute (m), T3 TE50 (m), BMW Z4 (m) AFF motto - If contrary views trigger, please use ignore button.

|

|||

|

|

|

|

|

#6 | ||

|

FF.Com.Au Hardcore

Join Date: Jul 2009

Location: melbourne

Posts: 4,669

|

Negative gearing is where a loan is used to buy an asset and there is a loss because the income generated is lower than the interest repayments. It's often used to explain a property purchase but it can equally apply to a share purchase or other investment.

It's been with us for a long time. In 2010 there were 1.2 million Aussies with a negatively geared property which is 14.3% of individuals that lodged a tax return owned investment properties while a greater 19.2% of individuals that reported a taxable income owned investment properties. http://blog.corelogic.com.au/2013/05...inancial-year/ Whilst some pressure comes from negative gearing when people speculate on prices going up is it really the driver behind the sharp rises we are seeing? Some more recent info here https://www.businessinsider.com.au/s...the-rba-2016-2 Good article http://theconversation.com/policyche...g-reform-58404 It does provide an incentive for people to invest in property just on balance it seems to me unlikely to be the driver behind the last 4 years price expansion. |

||

|

|

|

|

|

#7 | ||

|

FF.Com.Au Hardcore

Join Date: Oct 2014

Location: Newcastle

Posts: 1,791

|

As CoolBFWagon said, the Chinese are a huge country, becoming very wealthy, and they like investing their hard earned in a stable country in bricks and mortar that is safe. Property is very expensive there in their big cities, and Australia is good buying for them.

So Sydney, Melbourne are seeing big inputs of Chinese purchasers. Also, SMSF re now being used to purchase properties which further increases prices. So the older more well heeled are further using negative gearing/SMSF to buy property and cash in on capitals returns, and in effect will have the young slave away to pay for their capital gains, all while getting the young to pay their rents as the young cannot get into property.

__________________

Ford Rides: Ford Fiesta ST Mk 8 -daily- closest thing to a go kart on road for under 50K FG X XR8 smoke manual - Miami hand built masterpiece by David Winter, BMC Filter, JLT Oil separators, Street Fighter Intercooler Stage 2, crushed ball, running 15% E85 and 85% 98- weekender |

||

|

|

|

|

|

#8 | |||

|

IWCMOGTVM Club Supporter

Join Date: Sep 2005

Location: Northern Suburbs Melbourne

Posts: 17,799

|

Quote:

This needs to be scaled back as the market needs a correction. The house prices in my area are rediculous.

__________________

Daniel |

|||

|

|

|

| This user likes this post: |

|

|

#9 | ||

|

FF.Com.Au Hardcore

Join Date: Jul 2009

Location: melbourne

Posts: 4,669

|

Yes but increasing CGT would impact the stock market greatly I would assume?

|

||

|

|

|

| This user likes this post: |

|

|

#10 | ||

|

WT GT

Join Date: Jan 2006

Location: The GSS

Posts: 17,773

|

There would be a rush away from housing to equities. That's not necessarily a bad thing but then the price of stocks will rise - not because they are better stocks but because they will be bid up. Dangerous territory.

|

||

|

|

|

|

|

#11 | |||

|

IWCMOGTVM Club Supporter

Join Date: Sep 2005

Location: Northern Suburbs Melbourne

Posts: 17,799

|

Quote:

There should also be a limit on the amount of houses that are negatively geared and only Australians citizens should be able to buy propertly below 5 million.

__________________

Daniel |

|||

|

|

|

|

|

#12 | ||

|

The 'Stihl' Man

Join Date: Jan 2005

Location: TAS

Posts: 27,588

|

Its a pretty crap situation all round.

One idea I had was governments properly investing/encouraging companies to move to more "regional" areas. It would move people out of the cities to follow the jobs, the cities are big and ugly enough to fend for themselves. Alot of these regional areas have been hit with the industrial down turn and really could do with a spruce up. You then also take some demand for housing from the cities and outlying areas and the market will naturally sort itself out.

__________________

Last edited by Polyal; 19-04-2017 at 01:20 PM. |

||

|

|

|

| 7 users like this post: |

|

|

#13 | ||

|

WT GT

Join Date: Jan 2006

Location: The GSS

Posts: 17,773

|

OK. So 20 years ago I was encouraged by Gov-Co to invest for my own retirement and avoid the public teat. I did so all my life and have done pretty well. Went without on many fronts and invested instead.

Now I'm to blame (as a greedy investor) for the unaffordability of housing and the smashed avocados are being given every advantage Gov-Co can muster...  Go figure.

|

||

|

|

|

| 21 users like this post: |

|

|

#14 | ||

|

FF.Com.Au Hardcore

Join Date: Jul 2009

Location: melbourne

Posts: 4,669

|

Great point Fairmont.

Median house price in Melb is nearing $800k In 2010 it was $465,000. Spectacular return for investors. In 1997, 20 years ago it was $125k. https://www.domain.com.au/news/melbo...170123-gtvh6k/ https://services.land.vic.gov.au/lan...2011Sample.pdf Dam the second link is Victorian median price not quite apples with apples but illustrates the rise. Last edited by zipping; 19-04-2017 at 02:33 PM. |

||

|

|

|

|

|

#15 | ||

|

FF.Com.Au Hardcore

Join Date: Feb 2008

Location: WA

Posts: 3,705

|

I don't care, I own my own house and owe nobody nothing.

I know lots of people in Perth who have bought investment properties there and are currently being burnt big time. Most of them thought they were buying a money tree, problem is there's no-one to water it.

__________________

www.bseries.com.au/mercurybullet 2016 Falcon XR8. Powered by the legend that is - David Winter. XC Cobra #181. 1985 Mack Superliner, CAT 3408, 24 speed Allison. |

||

|

|

|

|

|

#16 | |||

|

Cabover nut

Join Date: Aug 2015

Location: Onsite Eastcoast

Posts: 11,324

|

Quote:

__________________

heritagestonemason.com/Fordlouisvillerestoration In order that the labour of centuries past may not be in vain during the centuries to come...... D. Diderot 1752

|

|||

|

|

|

| This user likes this post: |

|

|

#17 | ||

|

Thailand Specials

Join Date: Aug 2009

Location: Centrefold Lounge

Posts: 49,587

|

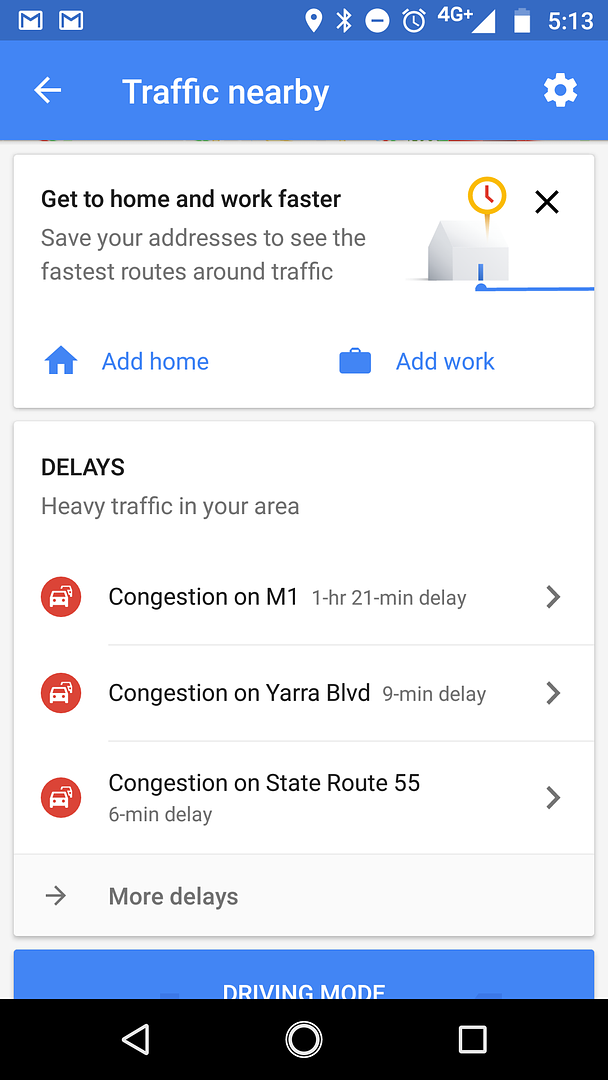

Median house price close to 7 figures - no one can afford so buy so buy out in the South Eastern suburbs and use the M1 Freeway to go to and from work - toll road:

1 hour 20 min delay Monday-Friday for a toll road while it takes 2+ hours to go to your house you can barely afford mortgage payments on in Dandenong only 30km away from work in Melbourne where your house gets broken into every second week by Africans - but it only cost $600K. Or you might be one of the lucky ones and live where I do 62km from work in Melbourne where our highway is free and our houses only cost $450K!  Except we're all currently doing 0KM/H out of the 100 permitted. #mostliveablecity Last edited by Franco Cozzo; 21-06-2018 at 05:34 PM. |

||

|

|

|

| This user likes this post: |

|

|

#18 | |||

|

WT GT

Join Date: Jan 2006

Location: The GSS

Posts: 17,773

|

Quote:

And you're being racist!

|

|||

|

|

|

|

|

#19 | ||

|

Call me dirt... Joe Dirt

Join Date: May 2009

Location: Back in Perth for good

Posts: 5,302

|

Why the hate towards Negative Gearing?

Without it there would be no financial reason for people to buy investment properties. Who would then provide the properties to service the rental market? The Government? Negative Gearing is basically the governments way of providing housing through private ownership. I know it's easy to blame NG for high property prices, but its impact is minute.

__________________

2007 BFII FPV Cobra Ute|Boss 302|6M|#23/100 Mods so far: Billet Products Shifter|X-Force Exhaust|Herrod Oil Breathers|Whiteline Sway Bar|Tein SuperStreets|Kings FOR-303SL Rear Springs|Melling Oil Pump|Mace Manifold Spacers|Powerbond Underdrives|Pacemaker Headers|Ballistic Cats|XFT Custom Tune @ 308.3rwkw|DBA T3 Rotors|Ferodo Pads|Goodridge Braided Lines Mods to come: 4.11 Diff Gears|Chromoly Tailshaft I use & recommend: Castrol|Motorcraft|Mainlube|Penrite Check Out My Build Thread Last edited by Pepscobra; 19-04-2017 at 03:21 PM. |

||

|

|

|

| 7 users like this post: |

|

|

#20 | ||

|

^^^^^^^^

Join Date: Jan 2005

Location: online - duh

Posts: 9,642

|

It's the negative gearing + capital gain tax discounts together. Investing is meant to be a risky business, the above policies have pretty much made it as safe as houses (see what I did there) for the past few decades.

Time for a major correction IMHO - driven by sensible policy adjustment. If the above policies were meant to add to the housing supply - they have failed whenever an investors purchases an existing property (i.e. most of the time). If the capital gains tax discount was to adjust for the erosion caused by inflation - why is it still so high whilst inflation is now so low? Housing should be for living in, investors money should be spent on more productive assets. Wonder why the retailers etc are doing it so tough, not employing anyone and generally grinding the economy to a halt? It's because after people pay for rent or their mortgage there's SFA all for anything else. .

__________________

.  Last edited by Raptor; 19-04-2017 at 03:38 PM. |

||

|

|

|

|

|

#21 | |||

|

Regular Member

Join Date: Dec 2014

Location: SE QLD

Posts: 91

|

Quote:

__________________

~Internal combustion motor enthusiast~ |

|||

|

|

|

| 2 users like this post: |

|

|

#22 | ||

|

FF.Com.Au Hardcore

Join Date: Sep 2014

Location: Catland

Posts: 3,793

|

Open market to widgets from all nations, stop protecting local widget maker, stop making widget, layoff local widget assemblers, import cheaper widget from China to $ave $$$, see immediate Aussie lifestyle improvement today (bargain mate!), $$$ flow to China; allow open RE ownership, $$$ comes back with vengeance turbocharged by yuan printing, Chinese $$$ buyers compete for housing stock, housing prices rise exponentially, your kids can't afford housing in the country of their birth. Nor can the laid off widget assemblers.

Traffic goes mental. Sit back and have a beer while admiring the great deal you got on the widget.  (To be fair, could replace 'China' with UK or US or Uzbekistan or many others...)

__________________

I6 + AWD |

||

|

|

|

| This user likes this post: |

|

|

#23 | ||

|

FF.Com.Au Hardcore

Join Date: Feb 2005

Posts: 5,075

|

Pepsicobra, people dont invest in rental properties with a view to earn a steady rental income, they do so to get a capital gain. Being able to negative gear along the way removes a lot of the risk of speculative investing because the taxpayer effectively picks up the tab for managing your cashflow. And when you have limited supply but low barrier to entry, you inevitably end up with demand exceeding supply and price growth.

|

||

|

|

|

|

|

#24 | |||

|

WT GT

Join Date: Jan 2006

Location: The GSS

Posts: 17,773

|

Quote:

But you may be right nowadays, maybe the focus has swung too heavily on speculation of gain from price increases. |

|||

|

|

|

| 2 users like this post: |

|

|

#25 | |||

|

FF.Com.Au Hardcore

Join Date: Jul 2009

Location: melbourne

Posts: 4,669

|

Quote:

It's in their interests because of the taxes collected. http://www.pitcher.com.au/news/vic-s...property-taxes Literally a transfer of wealth from private to public hands. |

|||

|

|

|

|

|

#26 | ||

|

bitch lasagne

Join Date: Aug 2012

Location: Sonova Beach

Posts: 15,110

|

The root cause of the housing affordability problem (and the rest of the economic woes) isn't negative gearing or capital gains related, nor is it about supply and demand. It exists along with the other economic maladies because the banks control the currency and not the treasury. Because as it stands, for every dollar in the form of cash, there are ten more that are credit-derived (any form of bank-sourced credit).

Sound money issued by the treasury and only the treasury (whether it be in the form of physical notes and coins, their electronic equivalent, gold and silver or a combination of all three) wouldn't allow the banks to issue credit hand over fist and fuel a speculators paradise.

__________________

|

||

|

|

|

| 6 users like this post: |

|

|

#27 | |||

|

WT GT

Join Date: Jan 2006

Location: The GSS

Posts: 17,773

|

Quote:

No no no no  It is entirely about supply and demand. Look at Sid-en-knee - we're full to the gills! There's no more viable land and what is available is down the Hume with rubbish infrastructure. And yet, Gov-Co continues to allow people to settle there - up to 80,000 short-fall of people looking for a dwelling in the city last year. Add that to the existing back-log, plus he fact that there's so much money washing around looking for an investment, and there's your problem. But you can't force people into settling away from where they want to live - that's called China, a command economy. I don't know what the answer is...

|

|||

|

|

|

| 4 users like this post: |

|

|

#28 | |||

|

bitch lasagne

Join Date: Aug 2012

Location: Sonova Beach

Posts: 15,110

|

Quote:

__________________

|

|||

|

|

|

| 2 users like this post: |

|

|

#29 | |||

|

WT GT

Join Date: Jan 2006

Location: The GSS

Posts: 17,773

|

Quote:

|

|||

|

|

|

| 2 users like this post: |

|

|

#30 | |||

|

bitch lasagne

Join Date: Aug 2012

Location: Sonova Beach

Posts: 15,110

|

Quote:

__________________

|

|||

|

|

|

| 2 users like this post: |